Manpower Module Overview

The Manpower Module is your complete solution for managing employee payroll, attendance, and human resources. This module handles everything from daily timekeeping to monthly salary computation and government contributions.

What Can You Do With Manpower?

The Manpower Module helps you:

- 📊 Track employee attendance and working hours

- 💰 Process payroll and generate payslips

- 👥 Manage employee information and records

- 📅 Schedule shifts and manage team assignments

- 📋 Generate government-mandated reports (SSS, PhilHealth, Pag-IBIG)

- ⚙️ Configure payroll rules and deductions

Module Sections

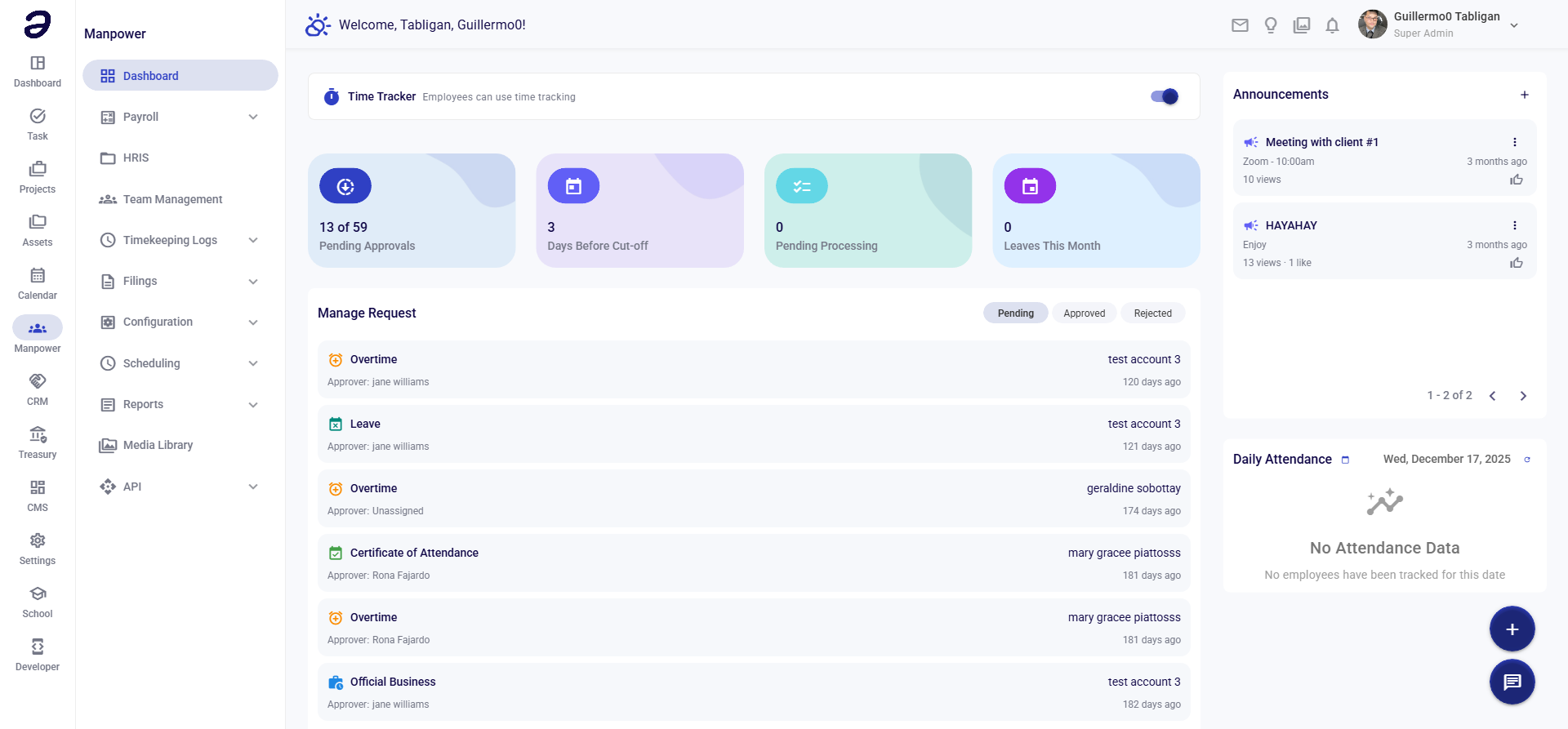

Dashboard

Your central hub for payroll metrics and employee overview. See at-a-glance information about:

- Active employees

- Pending payroll runs

- Attendance summaries

- Recent activities

Payroll

Complete payroll processing system:

- Payroll Time Keeping - Review and approve employee time records

- Payroll Center - Process and calculate salaries

- Payslip Center - Generate and distribute payslips

HRIS

Human Resource Information System for managing:

- Employee profiles and personal information

- Employment history and documents

- Benefits and compensation details

- Leave balances and requests

Team Management

Tools for managing your workforce:

- Team Attendance - Monitor daily attendance across teams

- Team Shifting Management - Assign and modify work shifts

- Team Management - Organize employees into teams and departments

Timekeeping Logs

Raw attendance data management:

- Time Keeping Device - Configure biometric devices

- Time Importation - Import attendance from external sources

- Raw Logs Browse - View and edit raw attendance data

Configuration

System setup and maintenance:

- Payroll Group - Define employee categories

- Holidays - Set regular and special holidays

- Service Incentive Leaves - Configure leave policies

- Deductions - Set up salary deductions

- Allowances - Configure additional compensation

- Payroll Approvers - Assign approval authorities

- Tax Table - Maintain tax computation tables

- PhilHealth - Configure PhilHealth contributions

- SSS - Set up SSS contribution tables

- Pag-IBIG - Configure Pag-IBIG contributions

- Schedule Management - Create work schedules

- Shift Management - Define shift patterns

- Cut-off Management - Set payroll periods

Scheduling

Employee work schedule assignment:

- Individual Scheduling - Assign schedules per employee

- Team Scheduling - Bulk schedule assignments

Reports

Government-mandated contribution reports:

- SSS Contributions - Monthly SSS remittance reports

- PhilHealth Contributions - PhilHealth contribution reports

- Pag-IBIG Contributions - Pag-IBIG remittance reports

- Tax Withholding - BIR tax reports and alphalists

Quick Start Guide

For First-Time Users

Set Up Configuration (Admin only)

- Configure holidays for the year

- Set up government contribution tables

- Define payroll groups and schedules

Add Employees to HRIS

- Enter employee information

- Assign to payroll groups

- Set up salary and benefits

Configure Time Keeping

- Set up biometric devices

- Import existing attendance data

- Verify time logs

Process Your First Payroll

- Review attendance records

- Calculate salaries

- Generate payslips

Common Tasks

- 📝 How to Process Payroll

- ⏰ Managing Employee Attendance

- 👤 Adding New Employees

- 📊 Generating Government Reports

- 🗓️ Setting Up Holidays

Tips for Success

✅ Best Practices:

- Always verify attendance before processing payroll

- Keep employee information up to date

- Process payroll at least 2 days before payday

- Backup data before major operations

- Review government contribution tables quarterly

⚠️ Important Reminders:

- Payroll calculations are irreversible once approved

- Government reports must be filed on time

- Keep copies of all generated payslips

- Maintain audit trails for all changes

Need Help?

- 📚 Check specific section guides for detailed instructions

- 🎥 Watch video tutorials (if available)

- 📧 Contact HR/Payroll support team

- 💬 Ask your system administrator

💡 Note: Access to certain features depends on your user role and permissions. Contact your administrator if you need additional access.